Where Can I Print Out A 1099 Misc Form 1099 MISC and its instructions such as legislation enacted after they were published go to www irs gov Form1099MISC Free File Program Go to www irs gov FreeFile to see if you

To ease statement furnishing requirements Copies B 1 and 2 have been made fillable online in a PDF format available at IRS gov Form1099MISC and IRS gov Form1099NEC You can To download and print 1099 forms visit IRS gov and type 1099 into the search bar You can also visit this page by clicking on this link Look

Where Can I Print Out A 1099 Misc

Where Can I Print Out A 1099 Misc

https://fitsmallbusiness.com/wp-content/uploads/2022/05/FeatureImage_Form_1099.jpg

1099 Forms 2025 Omar Lila

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

1099 Form Example

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Click on the printer icon located at the bottom center of the page or choose File and Print from the drop down menu in your web browser to display the print menu window Adjust print In the Choose a filing method window select Print 1099 NECs or Print 1099 MISCs Specify the date range for the forms then select all vendors you wish to print 1099s Select Print 1099

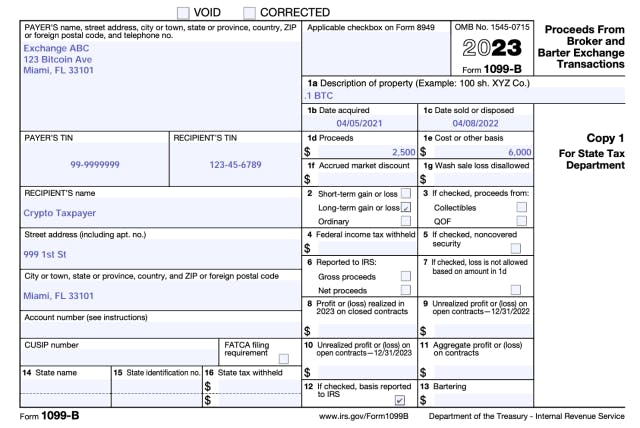

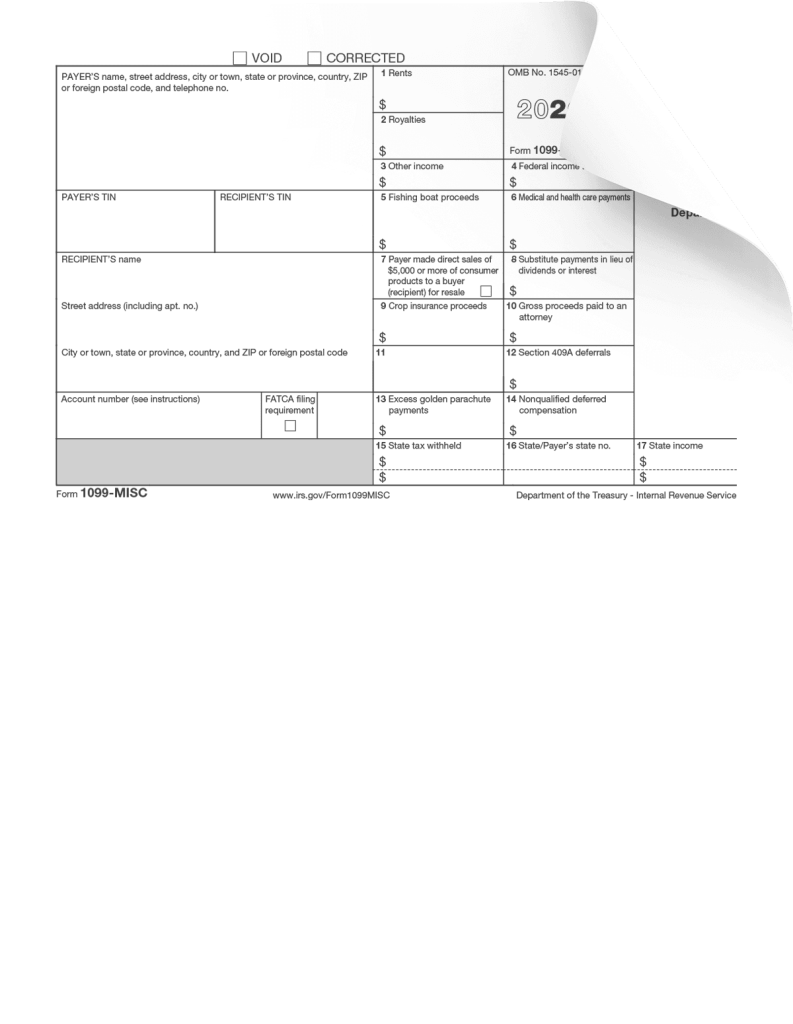

You can certainly use the Adobe pdf blank 1099 MISC form available from the IRS gov website to print Form 1099 MISC and give copies B C to your independent You need to collect and verify the required information to fill out and print form 1099 MISC This information includes recipient s name recipient s address recipient s social security number

More picture related to Where Can I Print Out A 1099 Misc

2024 Misc 1099 Template Dido Myriam

https://images.prismic.io/accointing/M2RiNDc4MjgtMjBkNi00ZGRlLWE4NDctYzFjYzYxMjAwZmM4_image-5.pngresize6402c428ampssl1?auto=compress,format&rect=0,0,640,428&w=640&h=428

Fillable 1099 misc 2023 Fillable Form 2024

https://fillableforms.net/wp-content/uploads/2022/10/1099-misc-instructions-2023-1099-forms-taxuni-3.jpg

1099 Limit 2025 Olly Timmie

https://assets-global.website-files.com/61cda68a44d8582ffab97e14/644b8381837f48dfb7e595be_8d8cec7c.png

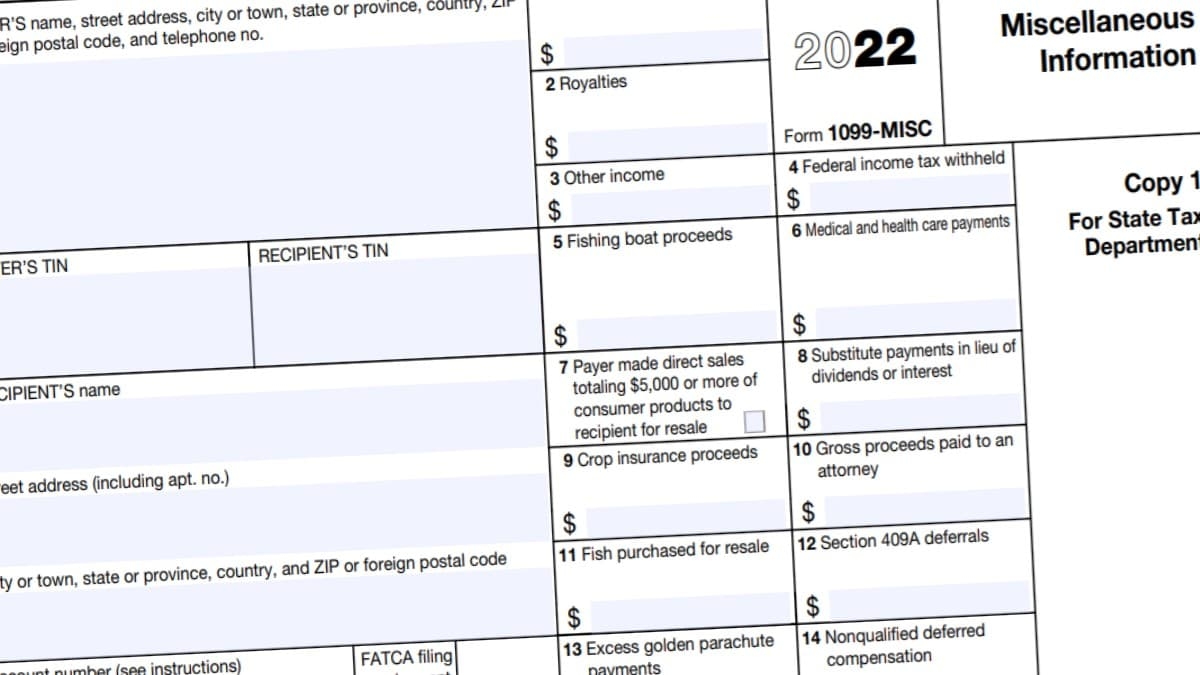

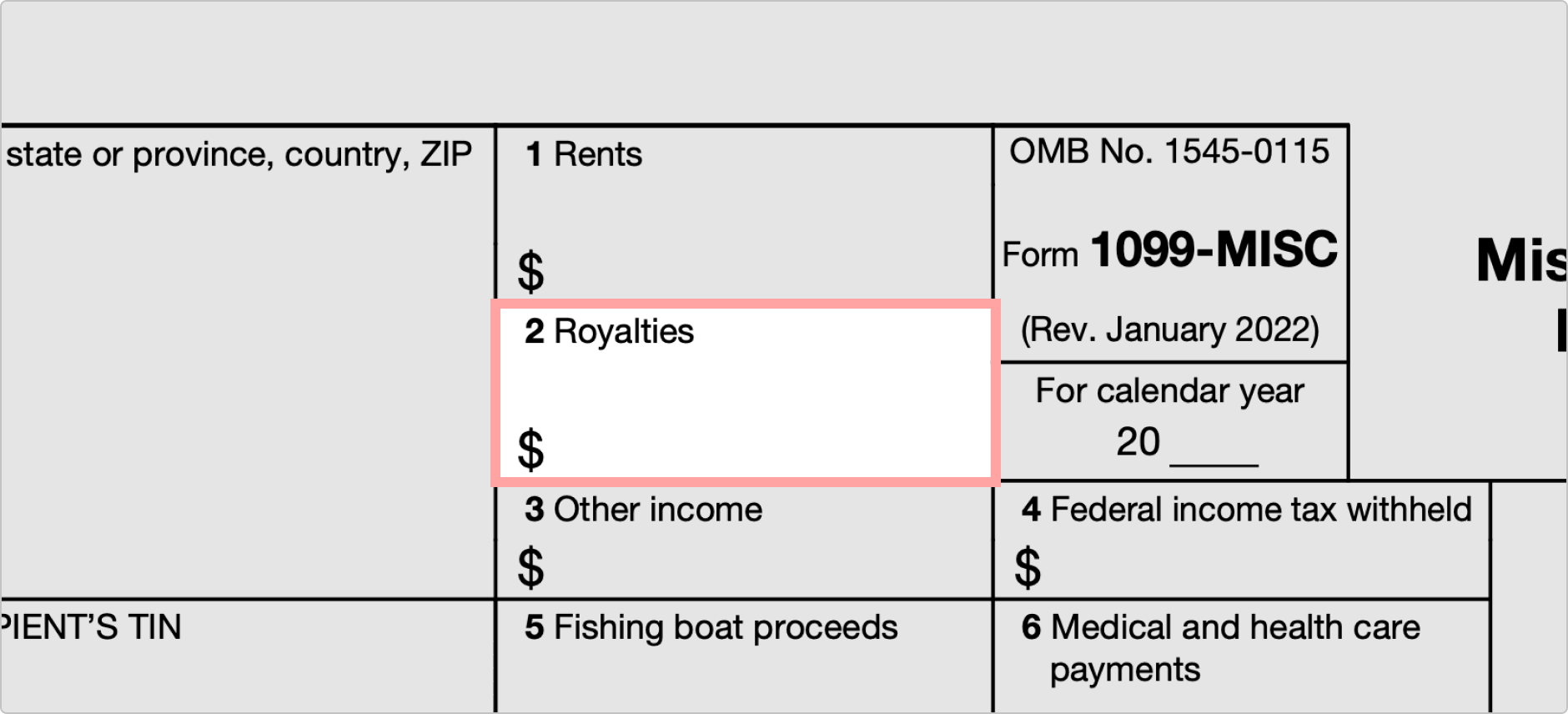

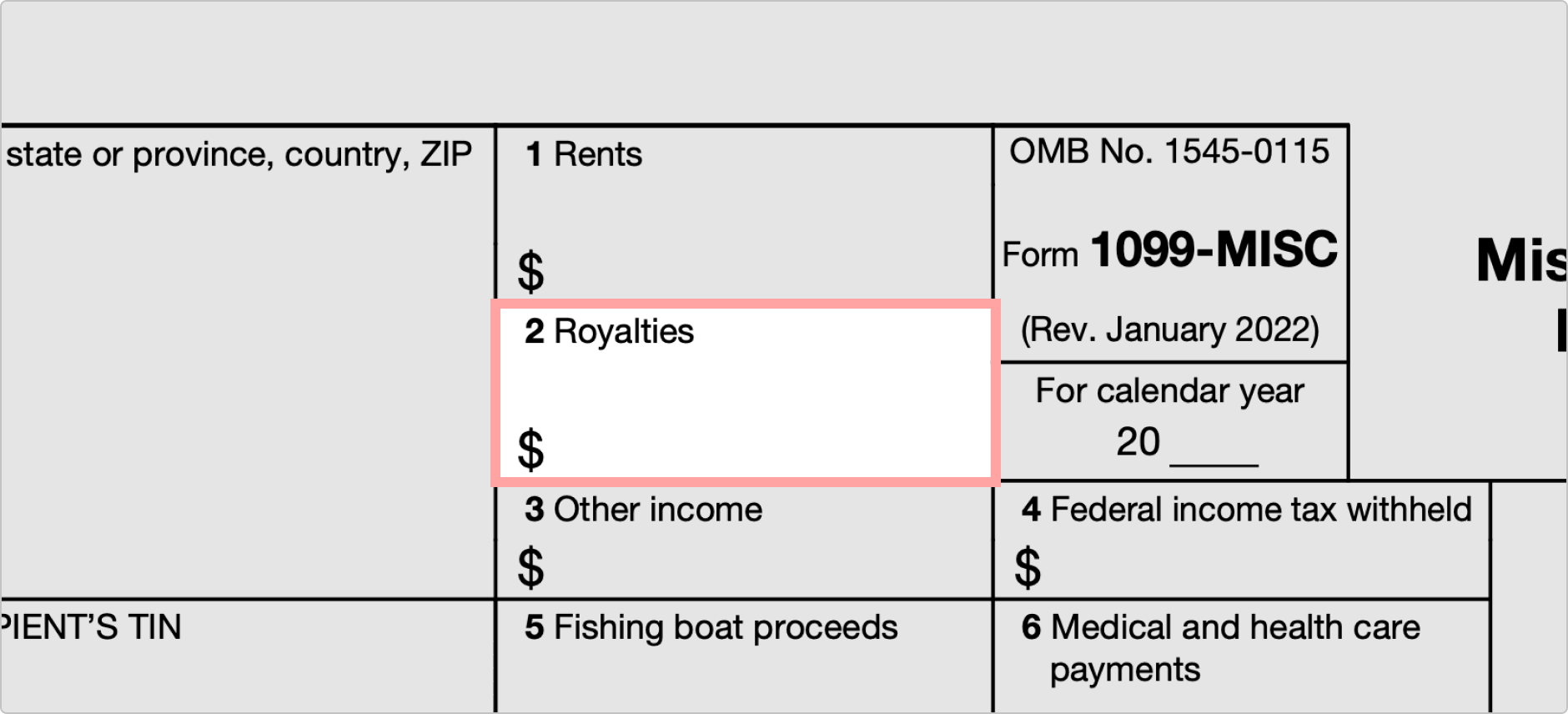

You can Print 1099 s from QuickBooks Online by following the instructions below Printing 1099 MISC Forms From QuickBooks Online navigate to the Expenses tab and the Vendors section Click Prepare 1099 s A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific

Use the following instructions to print your Forms 1099 MISC and 1099 NEC Load your IRS approved 1099 Copy A forms red pre printed forms in your printer This is the IRS copy If Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS which is located at www irs gov Once you ve received your copy of the

1099 MISC Software Includes Electronic Filing Printing And IRS Bulk

http://www.idmsinc.com/images/screenshots/1099MISC.gif

1099 Form 2022

https://i.etsystatic.com/25616924/r/il/ac54da/4490072410/il_fullxfull.4490072410_h97j.jpg

https://www.irs.gov › pub › irs-pdf

Form 1099 MISC and its instructions such as legislation enacted after they were published go to www irs gov Form1099MISC Free File Program Go to www irs gov FreeFile to see if you

https://www.irs.gov › pub › irs-pdf

To ease statement furnishing requirements Copies B 1 and 2 have been made fillable online in a PDF format available at IRS gov Form1099MISC and IRS gov Form1099NEC You can

1099 Printable Form 2025 Merle Stevana

1099 MISC Software Includes Electronic Filing Printing And IRS Bulk

1099 Printable Forms

1099 Nec Printable Form 2024

2025 2025 Misc Form Fillable Mariam Grace

1099 Misc Form 2022

1099 Misc Form 2022

Fillable Form 1099 Misc 2023 Fillable Form 2024

Printable Form 1099 Nec

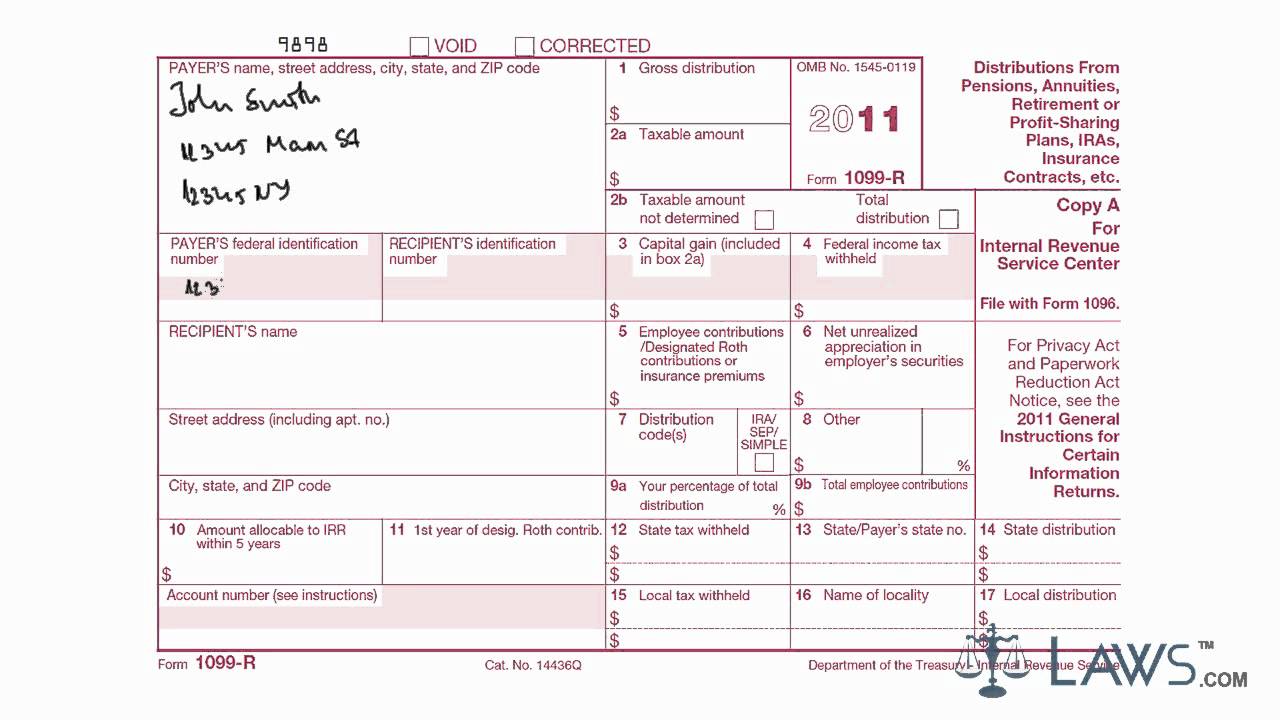

1099 R Simplified Method Worksheets

Where Can I Print Out A 1099 Misc - You can either get the forms at an office supply store Copy A has special red ink that the IRS requires or you can e file the 1099s through Quick Employer Forms If you e file